Conquer Your Savings Goals: How to Save $10,000 in 52 Weeks

Reaching a significant savings goal can feel daunting, but with the right approach, it's achievable. The 52-week savings challenge is a popular, effective method to save $10,000 in a year, and it's surprisingly simple.

Here's how it works:

Weekly Savings

Each week, you save a specific amount. The traditional method starts with $1 in week one and increases by $1 every week, reaching $52 in the final week. This adds up to $1,378 saved in the first year.

Reverse Approach

Feeling ambitious? Start with $52 in week one and decrease by $1 each week. This also reaches $1,378.

Choose Your Increment

You can customize the challenge to fit your budget. Decide on an increment that works for you, whether it's $5, $10, or even $25, and adjust the starting and ending points accordingly.

Tips for Success:

Automate your savings

Set up automatic transfers from your checking account to your savings account each week. This removes the temptation to spend and ensures consistency.

Track your progress

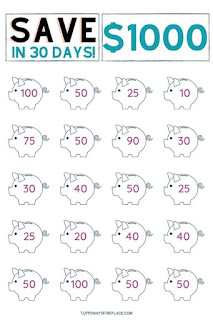

Use a printable tracker, spreadsheet, or budgeting app to visualize your progress. Seeing your savings grow can be a great motivator.

Find extra cash

Look for ways to generate additional income, like selling unused items or taking on a side hustle. Channel this extra income directly into your savings.

Reduce spending

Analyze your spending habits and identify areas where you can cut back. Every dollar saved is a dollar closer to your goal.

Celebrate milestones

Reward yourself for reaching milestones, like completing a month or a quarter of the challenge. This helps maintain motivation and keeps you focused.

Remember

Consistency is key. Even if you miss a week or two, don't give up! Get back on track and keep moving forward. The 52-week challenge is a fantastic way to build a healthy savings habit and achieve your financial goals.

Posting Komentar untuk "Conquer Your Savings Goals: How to Save $10,000 in 52 Weeks"